Capital Gains Tax California. Federal income tax on the net total of all their capital gains. That cut is the capital gains tax. Alan clopine, cpa and director of tax planning for pure financial advisors shares strategies for reducing or avoiding california capital gains tax. California's tax brackets are set up to aggressively tax higher income brackets —but the higher brackets start high and are broad. Figuring the tax hit can get complicated because it. 2021 capital gains tax brackets. California's tax system is harsh, and its top 13.3% rate is high. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level.

2021 capital gains tax brackets. If your primary residence is in california, add 9.3% for the state tax rate (this could be less for some taxpayers). What's more, there's no such thing as a capital gain tax rate in california.

Alan clopine, cpa and director of tax planning for pure financial advisors shares strategies for reducing or avoiding california capital gains tax.

Capital gains taxes are a type of tax on the profits earned from the sale of assets such as stocks, real estate, businesses and other types of investments. Reports about new capital gains tax hikes shook us stock markets on thursday, sending major indices lower. There are a few other exceptions where capital gains may be taxed at rates greater than 20%: However, a net capital gain tax rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate. California, new york, and new jersey would have combined rates of more than 54 percent. California does not have a lower rate for capital gains. Capital gains taxes apply to what are known as capital assets. California's tax system is harsh, and its top 13.3% rate is high. If your primary residence is in california, add 9.3% for the state tax rate (this could be less for some taxpayers). The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent).

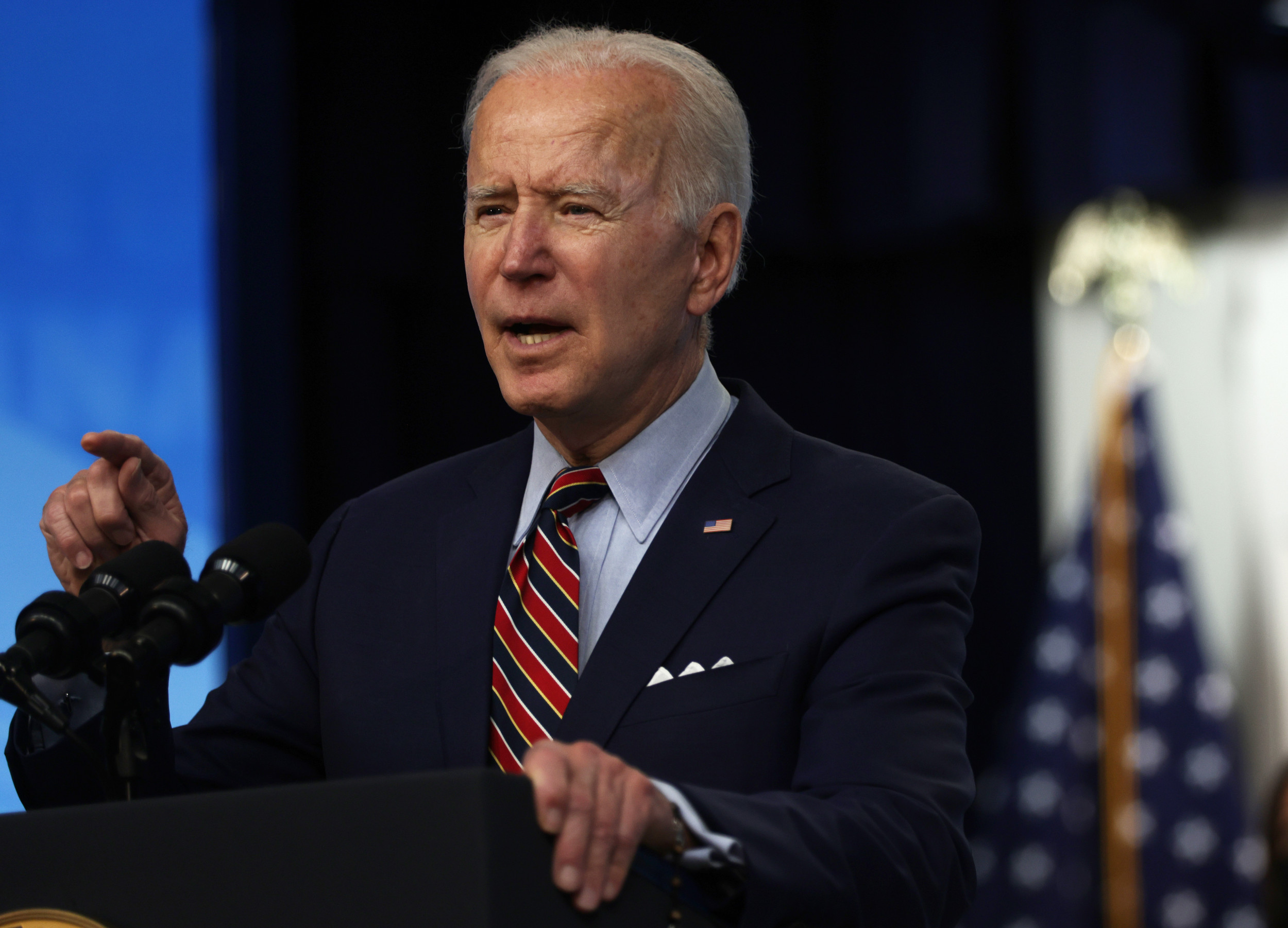

2021 capital gains tax brackets. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). I am selling a rental home i own in california (i currently live out of state). Generally, capital gains and losses occur when you sell something for more or less than you spent to purchase it. California residents must pay taxes on gains or profits they make from the sale of property. The biden administration could potentially increase the capital gains rate to 43.4% for households earning at least $1 million. When someone sells a capital asset, the difference between the asset's basis, or original cost. In california and new york, like most other states, state capital gains are taxed at your ordinary state income tax rate. For tax purposes, it's useful to understand the difference between realized gains and unrealized gains. Top combined rates in some localities would go even higher.

It relies on the fact that money you lose on an investment can offset your capital gains on other investments.

When your investment rises in value, there's usually a tax implication. Reports about new capital gains tax hikes shook us stock markets on thursday, sending major indices lower. California taxes capital gains the same as ordinary income, at rates up to 13.3 percent. Is there an additional capital i need help. Biden eyes capital gains tax hike. Figuring the tax hit can get complicated because it. If your primary residence is in california, add 9.3% for the state tax rate (this could be less for some taxpayers). Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). Capital gains taxes apply to what are known as capital assets. There is an additional 3.8 percent tax on unearned income to fund the affordable care act for certain income levels. Earlier, in the session, stocks were little changed and struggled for direction. The current base capital gains tax rate is 20%. It relies on the fact that money you lose on an investment can offset your capital gains on other investments.

That cut is the capital gains tax. The tax rates on your salary or business income and capital gains are not uniform. It relies on the fact that money you lose on an investment can offset your capital gains on other investments.

Assets include shares of stock, a piece of land, jewelry, coin collections, or a business.

Your business income is taxable at applicable tax slab rates. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent). Understanding california capital gains tax rate obligations can help you make smart decisions for your financial future. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level. A capital gains tax is a tax levied on the profit gleaned from the sale of a capital asset. 2021 capital gains tax brackets. Capital gains taxes apply to what are known as capital assets. 2000 california principal interest law 2000 california principal & income law on the other hand, capital gains are almost always principal (even though these receipts are subject to income tax.). How capital gains are calculated. Biden eyes capital gains tax hike. Assets include shares of stock, a piece of land, jewelry, coin collections, or a business. Which assets qualify for capital gains treatment? All capital gains are taxed as ordinary income. Rt's boom bust spoke to joseph gissy. That cut is the capital gains tax.

There is an additional 38 percent tax on unearned income to fund the affordable care act for certain income levels capital-gains tax. The current base capital gains tax rate is 20%.

Posting Komentar untuk "Capital Gains Tax California"